This compound interest calculator is a tool to help you estimate how much money you will earn on your deposit. In order to make smart financial decisions, you need to be able to foresee the final result. That’s why it’s worth knowing how to calculate compound interest. The most common real-life application of the compound interest formula is a regular savings calculation. In reality, investment returns will vary year to year and even day to day. In the short term, riskier investments such as stocks or stock mutual funds may lose value.

Do checking accounts earn compound interest?

If short-term interest rates are higher than long-term rates, for instance, you may be able to earn more money by choosing a shorter term. If you want to make the inverse calculation, you can also use the savings calculator. This tool helps you estimate how much you’ll save or how much you need to deposit if you have a certain amount as your goal. The APY Calculator is a tool that enables you to calculate the actual interest earned on an investment over a year. Note that 10% is, roughly, the long-term annualized return of the S&P 500. Returns like this, compounded over long periods, can result in some pretty impressive performances.

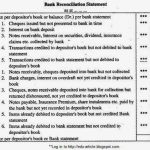

Compound earnings vs. compound interest

You can how over the chart bars to see individual metrics for any of the calculated yearly time series. However, if Derek has a marginal tax rate of 25%, he will end up with $239.78 only because the tax rate of 25% applies to each compounding period. This interest is added to the principal, and the sum becomes Derek’s required repayment to the bank for that https://www.accountingcoaching.online/cash-flow-statement/ present time. A is the future value of the investment/loan, including interest. Ancient texts provide evidence that two of the earliest civilizations in human history, the Babylonians and Sumerians, first used compound interest about 4400 years ago. However, their application of compound interest differed significantly from the methods used widely today.

Total Balance

Otherwise, you’ll start accruing interest on whatever balance is still on the card. The compound interest calculator is used to check how much money can grow over time using the power of compounding. FV – The FV function calculates the future value of an annuity investment based on constant-amount periodic payments and a constant interest rate. Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all the accumulated interest of previous periods of a deposit. Anyone who wants to estimate compound interest in their head may find the rule of 72 very useful.

How to avoid interest on your credit card debt

When interest compounding takes place, the effective annual rate becomes higher than the nominal annual interest rate. The more times theinterest is compounded within the year, the higher the effective annual interest rate will be. To demonstrate the effect of compounding, let’s take a look at an example chart of an initial $1,000 investment. We’ll use a quickbooks desktop vs online 20 yearinvestment term at a 10% annual interest rate, to keep things simple. As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. This compounding effect causes investments to grow fasterover time, much like a snowball gaining size as it rolls downhill.

APR vs. interest rates

Using the definition above, the compound interest rate is the annual rate where the compounding frequency is taken into account. Use the compound interest rate calculator to compute the precise interest rate that is applied to an initial balance that reaches a certain surplus with a given compound frequency over a certain period. Compound interest is a type of interest that’s calculated from both the initial balance and the interest accumulated from prior periods. As you can see this time, the formula is not very simple and requires a lot of calculations.

In essence, our Finance Calculator is the foundation for most of our Financial Calculators. It helps to think of it as an equivalent to the steam engine that was eventually used to power a wide variety of things such as the steamboat, railway locomotives, factories, and road vehicles. There can be no Mortgage Calculator, or Credit Card Calculator, or Auto Loan Calculator without the concept of the time value of money as explained by the Finance Calculator. As a matter of fact, our Investment Calculator is simply a rebranding of the Finance Calculator while everything underneath the hood is essentially the same.

It can lead you to underspend and be miserable or overspend and run out of money. This book teaches you how retirement planning https://www.intuit-payroll.org/ really works before it’s too late. You only get one chance to retire, and the stakes are too high to risk getting it wrong.

Bear in mind that “8” denotes 8%, and users should avoid converting it to decimal form. Also, remember that the Rule of 72 is not an accurate calculation. Annual Interest Rate (ROI) – The annual percentage interest rate your money earns if deposited.

Nevertheless, lenders have used compound interest since medieval times, and it gained wider use with the creation of compound interest tables in the 1600s. Interest Earned – How much interest was earned over the number of years to grow. The conventional approach to retirement planning is fundamentally flawed.

Where I is the effective interest rate and the rest of the notation is as above. These formulas can be spun accordingly to solve for principal and time. If you wonder how to calculate compound interest, these formulas provide the answer. There is little difference during the beginning between all frequencies, but over time they slowly start to diverge. This is the power of compound interest everyone likes to talk about, illustrated in a concise graph.

- The above example has already shown the difference between simple versus compound interest.

- It will help to calculate how much principal needs to be invested to earn a certain amount of interest.

- Compound interest essentially means “interest on the interest” and is why many investors are so successful.

- NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

- You’ve selected an index fund that you believe will grow at 8% each year.

You may hear the terms compound interest and compound earnings used interchangeably, especially when discussing investment returns. The final value after 5 years is $11,041 whereas with simple interest it would have been just $11,000. This might not seem like much, but if the rate of return is higher or the period over which compounding occurs is longer, the compounding effect can be dramatic.

To maintain the value of the money, a stable interest rate or investment return rate of 4% or above needs to be earned, and this is not easy to achieve. This Compound Interest Calculator can help determine the compound interest accumulation and final balances on both fixed principal amounts and additional periodic contributions. There are also optional factors available for consideration, such as the tax on interest income and inflation. You can use this tool to make informed decisions about your investments or loans by understanding how compound interest affects the overall growth or cost over time. The Compound Interest Calculator below can be used to compare or convert the interest rates of different compounding periods.

Your daily balance is the amount you owe on your card at the end of each day, and your average daily balance is all of those daily balances added up and divided by the number of days in your billing cycle. APY is a measure of how much your money will grow by in one year as a percentage of the initial amount. The number should be present on the account, allowing you to easily compare between options. Annual percentage yield (APY) is a measurement that can be used to check which deposit account is the most profitable or whether an investment will yield a good return. Compound interest is the phenomenon that allows seemingly small amounts of money to grow into large amounts over time. To take full advantage of the power of compound interest, investments must be allowed to grow and compound for long periods.